1. The oil price spike of 2007-2008 and the financial crisis/housing bubble burst.

2. The “recovery" and QE for the bankers and Wall Street.

3. Spiking resource prices and the “Arab Spring.” Increasing scarcity of raw materials, foodstuffs, and fresh water.

4. The Shale oil fracking “revolution” and "Saudi America." Increasing U.S. production rates.

5. Climate change takes center stage. The political urgency of moving post-carbon energy intensifies. Unstable climate leads to drought, rising seas, and other destabilizing effects.

6. Renewables get better and cheaper. Efficiency measures and "green alternatives" become popular again.

7. China overtakes the U.S. as the world's largest user of natural resources and key economy for global growth.

8. The recession that never ends except on Wall Street. Falling economies means falling demand for energy. The gap between rich and poor has never been higher.

9. The Middle East goes up in flames. The rise of ISIS. Afghanistan and and Iraq fall apart. America’s foreign policy meltdown.

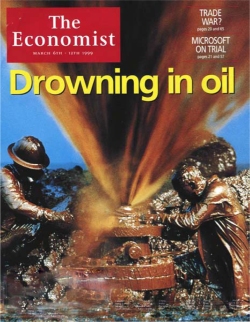

10. The Saudis engineer a plunge in oil prices to shut down competition from renewables and unconventional oil sources. OPEC is attempting to prevent the impetus to wean ourselves off of oil.

11. Globalization peaks.

12. China slows down and emerging markets can no longer make up for declinining wages in industrialized countires.

13. The future of Capitalism and Neoliberalism is in serious doubt.

It had been twenty-five years of falling or stable oil prices since the mid-eighties. The Seventies were a distant memory that people thought would never happen again.

In 2007, oil prices crossed the $100/barrel barrier. The causes are in dispute. There was no major supply shock like there was in the 1970s that could be pointed to. The Saudis blamed the weak dollar, because, remember, oil is priced in dollars, so a weaker dollar will cause oil producers to ask for more dollars for their oil. Speculation has also been blamed as a major culprit. And, of course, the concerns brought forth about Peak Oil played a role as well. The fear of Peak Oil can be said to have caused the fears to become realized. "In 2000, the phrase "peak oil" occurred just 2.5 times in every billion words published in English, according to Google's N-gram language-analysis tool, which can search an enormous corpus of books, articles and websites published in English and other languages. By 2008, the number of references had risen 65-fold to 160 occurrences per billion words." (source)

This caused a slow increase in oil, which spiked in 2008:

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including the falling value of the U.S. dollar, reports from the United States Department of Energy and others showing a decline in petroleum reserves worries over peak oil, Middle East tension, and oil price speculation.

[…]

The price of crude oil in 2003 traded in a range between $20–$30/bbl. Between 2003 and July 2008, prices steadily rose, reaching $100/bbl in late 2007, coming close to the previous all time inflation-adjusted record set in 1980. A steep rise in the price of oil in 2008 – also mirrored by other commodities – culminated in an all-time high of $147.27 during trading on 11 July 2008, more than a third above the previous inflation-adjusted high.

High oil prices and economic weakness contributed to a demand contraction in 2007–2008. In the United States, gasoline consumption declined by 0.4% in 2007, then fell by 0.5% in the first two months of 2008 alone. Record-setting oil prices in the first half of 2008 and economic weakness in the second half of the year prompted a 1.2 Mbbl/day contraction in US consumption of petroleum products, representing 5.5% of total US consumption, the largest decline since 1980 at the climax of the 1979 energy crisis.2000s Energy Crisis (Wikipedia)

A Brookings Institution study questioned whether it was oil prices, not the housing bubble, that caused the 2008 recession:

In a nutshell: Higher oil and gasoline prices whacked the U.S. auto industry, the effects of which cascaded through large swathes of the rest of the economy and helped curtail spending. Energy prices also pummeled consumers’ disposable income and confidence. To the extent that the housing meltdown did play a huge part in the recession, that too can be partially chalked up to higher oil prices: Cheap digs in the distant suburbs went underwater with $4 gasoline.

If true—and even [economist James] Hamilton is skeptical of his own findings—the implications are scary. First, it would mean vast improvements in energy efficiency in recent decades did not in fact insulate the U.S. economy from an oil shock. That was one of the main arguments economists wielded in explaining how the U.S (and other big economies) could weather $100 oil.

Second, it means the fate of the U.S. auto industry is even more important than thought.

Third, it makes the prospect of an imminent oil-price spike even more troubling. Lots of oil bulls, not to mention OPEC, figure today’s lowish oil prices are just setting the stage for a virulent rebound as soon as the economy gets off the canvas. That would crush any green shoots in a hurry.Did High Oil Prices Cause the Recession? (Wall Street Journal)

It wasn't just oil, the prices of all commodities was going up. Copper, wheat, and other foodstuffs also spiked in 2008, causing turmoil. Neoliberalism, having financialized the world and eliminated all restraints on the "free " market, had "freed" bankers and speculators to manipulate markets based on greed and fear. Wild speculation and price swings ruled the day. A spike in wheat prices caused turmoil across the Middle East and North Africa. While speculation played a role in the spike, so did the diversion of cereal grains as feedstocks for biofuel projects.

Oil wealth had made many countries in the Middle East rich, but had also caused population explosions based around imported food, and had cemented the rule of dictators, kings, and military strongmen. In 2008, the "Arab Spring" revolutions occurred across the Middle East. Normally, high oil prices would strengthen governments in oil producing countries as the rulers could throw more money at their people, but the price spike in food wasn't offset by government subsidies. Muammar Gaddafi, the Arab leader whose taking on of the oil companies back in 1970 led to rise of OPEC, was toppled from power.

Many of the Arab countries went into chaos. Some never recovered. Syria was plunged into a civil war and Iraq fell into sectarian fighting between Sunni, Shia and Kurds as many had predicted beforehand. When there is chaos, people will flock to whatever organization can wrest order from it. The only force uniting people in the artificial boundaries of the Middle East was fundamentalist Islam (funded in large part by Petrodollars), giving rise the the Islamic State, which increasingly took control in the power vacuum of Iraq and Syria.

After the invasion of Iraq, the Neocons in George W. Bush's cabinet wanted to go further. "Everyone wants to go to Baghdad. Real men want to go to Tehran," were the words of one official. If Iran and Iraq were under U.S. control, imagine how much control over oil prices we would have. Plus, there were persistent rumors that the Iranian government planned to open an oil bourse where oil could be traded in Euros rather than dollars, which may have been behind the belligerent rhetoric against Iran.

The Iranian Oil Bourse ...is a commodity exchange, which opened its first phase on 17 February 2008. ...The IOB is intended as an oil bourse for petroleum, petrochemicals and gas in various currencies other than the United States dollar, primarily the euro and Iranian rial and a basket of other major (non-US) currencies. The geographical location is at the Persian Gulf island of Kish which is designated by Iran as a free trade zone.

During 2007, Iran asked its petroleum customers to pay in non US dollar currencies. By December 8, 2007, Iran reported to have converted all of its oil export payments to non-dollar currencies. The Kish Bourse was officially opened in a videoconference ceremony on 17 February 2008, despite last minute disruptions to the internet services to the Persian Gulf regions. Currently the Kish Bourse is only trading in oil-derived products, generally those used as feedstock for the plastics and pharmaceutical industries. However, officially published statements by Iranian oil minister Gholamhossein Nozari indicate that the second phase, to establish trading in crude oil directly, which has been suggested might one day perhaps create a "Caspian Crude" benchmark price analogous to Brent Crude or WTI will only be started after the Bourse has demonstrated a reasonable period of trouble-free running.Iranian Oil Bourse (Wikipedia)

There are also convincing arguments that the reasons Hussein and Gaddafi were ousted when they were, after decades of despotic rule, had to do with challenging the international banking establishment:

Ellen Brown argues in the Asia Times that there were even deeper reasons for the war than gold, oil or middle eastern regime change.Brown argues that Libya – like Iraq under Hussein – challenged the supremacy of the dollar and the Western banks:Are The Middle East Wars Really About Forcing the World Into Dollars and Private Central Banking? (Washington's Blog)

Later, the same general said they planned to take out seven countries in five years: Iraq, Syria, Lebanon, Libya, Somalia, Sudan, and Iran. What do these seven countries have in common? In the context of banking, one that sticks out is that none of them is listed among the 56 member banks of the Bank for International Settlements (BIS). That evidently puts them outside the long regulatory arm of the central bankers’ central bank in Switzerland.

The most renegade of the lot could be Libya and Iraq, the two that have actually been attacked. Kenneth Schortgen Jr, writing on Examiner.com, noted that “[s]ix months before the US moved into Iraq to take down Saddam Hussein, the oil nation had made the move to accept euros instead of dollars for oil, and this became a threat to the global dominance of the dollar as the reserve currency, and its dominion as the petrodollar.”

According to a Russian article titled “Bombing of Libya – Punishment for Ghaddafi for His Attempt to Refuse US Dollar”, Gaddafi made a similarly bold move: he initiated a movement to refuse the dollar and the euro, and called on Arab and African nations to use a new currency instead, the gold dinar. Gaddafi suggested establishing a united African continent, with its 200 million people using this single currency.

Similarly, the invasion of Afghanistan also had to do with oil, as did the Syrian civil war:

...According to French intelligence officers, the U.S. wanted to run an oil pipeline through Afghanistan to transport Central Asian oil more easily and cheaply. And so the U.S. told the Taliban shortly before 9/11 that they would either get “a carpet of gold or a carpet of bombs”, the former if they greenlighted the pipeline, the second if they didn’t...Negotiations eventually broke down because of those pesky transit fees the Taliban demanded. Beware the Empire’s fury. At a Group of Eight summit meeting in Genoa in July 2001, Western diplomats indicated that the Bush administration had decided to take the Taliban down before year’s end...Soon after the start of the Afghan war, Karzai became president ...a mere year later, a U.S.-friendly Afghani regime signed onto TAPI. India just formally signed on to Tapi. This ended the long-proposed competitor: an Iran-Pakistan-India (IPI) pipeline.It’s Not Just the Oil. The Middle East War and the Conquest of Natural Gas Reserves (Center for Research on Globalization)

Virtually all of the current global geopolitical tension is based upon whose vision of the “New Silk Road” will control. Iran and Pakistan are still discussing a pipeline without India, and Russia backs the proposal as well...the “Great Game” being played right now by the world powers largely boils down to the United States and Russia fighting for control over Eurasian oil and gas resources...Russia and the USA have been in a state of competition in this region, ever since the former Soviet Union split up, and Russia is adamant on keeping the Americans out of its Central Asian backyard.

The third “big player” in this New Great Game is China, soon to be the world’s biggest energy consumer, which is already importing gas from Turkmenistan via Kazakhstan and Uzbekistan to its Xinjiang province — known as the Central Asia-China Pipeline — which may tilt the balance towards Asia...China’s need for energy is projected to increase by 150 per cent which explains why it has signed probably the largest number of deals not just with the Central Asian republics but also with the heavily sanctioned Iran and even Afghanistan. China has planned around five west-east gas pipelines, within China, of which one is operational (domestically from Xinjiang to Shanghai) and others are under construction and will be connected to Central Asian gas reserves.

You might ask why there is so much focus on Syria right now. Well, Syria is an integral part of the proposed 1,200km Arab Gas Pipeline...So yes, regime change was planned against Syria (as well as Iraq, Libya, Lebanon, Somalia, Sudan and Iran) 20 years ago.And yes, attacking Syria weakens its close allies Iran and Russia … and indirectly China.But Syria’s central role in the Arab gas pipeline is also a key to why it is now being targeted...Assad is being targeted because he is not a reliable “player”. Specifically, Turkey, Israel and their ally the U.S. want an assured flow of gas through Syria, and don’t want a Syrian regime which is not unquestionably loyal to those 3 countries to stand in the way of the pipeline … or which demands too big a cut of the profits...

The Trans-Afghanistan Pipeline (also known as Turkmenistan–Afghanistan–Pakistan–India Pipeline, TAP or TAPI) is a proposed natural gas pipeline being developed by the Asian Development Bank. The pipeline will transport Caspian Sea natural gas from Turkmenistan through Afghanistan into Pakistan and then to India. Physical work on the pipeline is expected to start in December 2015. The framework for the project's launch, as well as its completion, has been pushed back for many years: for instance, according to an April 2015 statement by Afghan President, the pipeline should become operational in 2020. The abbreviation TAPI comes from the first letters of those countries. Proponents of the project see it as a modern continuation of the Silk Road.Trans-Afghanistan Pipeline (Wikipedia)

According to retired NATO Secretary General Wesley Clark, a memo from the Office of the US Secretary of Defense just a few weeks after 9/11 revealed plans to "attack and destroy the governments in 7 countries in five years", starting with Iraq and moving on to "Syria, Lebanon, Libya, Somalia, Sudan and Iran." In a subsequent interview, Clark argues that this strategy is fundamentally about control of the region's vast oil and gas resources.Syria intervention plan fueled by oil interests, not chemical weapon concern (Nafeez Ahmed, The Guardian)

Much of the strategy currently at play was candidly described in a 2008 US Army-funded RAND report, Unfolding the Future of the Long War. The report noted that "the economies of the industrialized states will continue to rely heavily on oil, thus making it a strategically important resource." As most oil will be produced in the Middle East, the US has "motive for maintaining stability in and good relations with Middle Eastern states"...Exploring different scenarios for this trajectory, the report speculated that the US may concentrate "on shoring up the traditional Sunni regimes in Saudi Arabia, Egypt, and Pakistan as a way of containing Iranian power and influence in the Middle East and Persian Gulf." Noting that this could actually empower al-Qaeda jihadists, the report concluded that doing so might work in western interests by bogging down jihadi activity with internal sectarian rivalry rather than targeting the US.

The report noted especially that Syria is among several "downstream countries that are becoming increasingly water scarce as their populations grow", increasing a risk of conflict. Thus, although the RAND document fell far short of recognising the prospect of an 'Arab Spring', it illustrates that three years before the 2011 uprisings, US defence officials were alive to the region's growing instabilities, and concerned by the potential consequences for stability of Gulf oil.

These strategic concerns, motivated by fear of expanding Iranian influence, impacted Syria primarily in relation to pipeline geopolitics. In 2009 - the same year former French foreign minister Dumas alleges the British began planning operations in Syria - Assad refused to sign a proposed agreement with Qatar that would run a pipeline from the latter's North field, contiguous with Iran's South Pars field, through Saudi Arabia, Jordan, Syria and on to Turkey, with a view to supply European markets - albeit crucially bypassing Russia. Assad's rationale was "to protect the interests of [his] Russian ally, which is Europe's top supplier of natural gas."

Instead, the following year, Assad pursued negotiations for an alternative $10 billion pipeline plan with Iran, across Iraq to Syria, that would also potentially allow Iran to supply gas to Europe from its South Pars field shared with Qatar. The Memorandum of Understanding (MoU) for the project was signed in July 2012 - just as Syria's civil war was spreading to Damascus and Aleppo - and earlier this year Iraq signed a framework agreement for construction of the gas pipelines...It would seem that contradictory self-serving Saudi and Qatari oil interests are pulling the strings of an equally self-serving oil-focused US policy in Syria, if not the wider region....What is beyond doubt is that Assad is a war criminal whose government deserves to be overthrown. The question is by whom, and for what interests?

High oil prices combined with fears of Peak Oil led to the explorations of "alternative" sources of carbon and the exploitation of "tight" oil resources on the North American continent. These resources were uneconomical to exploit with cheap oil. The media reports centered around "technological innovation" bringing forth new oil, but in truth, many of these techniques were developed during the first oil crisis in the 1970s but were never implemented because oil was so cheap. Now they were dusted off and turned on the oil deposits in North America which had not previously been exploited.

For the entire oil and gas age, drillers had searched for hydrocarbons that had seeped out of layers of sedimentary rock over millions of years and collected into large pools. Once found, they were easy to produce. Engineers merely had to drill into the pools and the natural pressure of the earth would send huge volumes of oil and gas up to the surface. These pools are exceedingly rare, though, and they were quickly being tapped out as the world's consumption grew, raising fears that the end of the oil and gas age would soon be at hand and raising prices to alarming levels.Texas oilman, fracking pioneer Mitchell dies at 94 (AP)

[George P.] Mitchell's idea: Go directly to the sedimentary rock holding the oil and gas, essentially speeding up geological processes by thousands of millennia. He figured out how to drill into and then along layers of gas-laden rock, then force a slurry of water, sand and chemicals under high pressure into the rock to crack it open and release the hydrocarbons. This process, horizontal drilling and hydraulic fracturing, is the now-common industry practice known generally as fracking.

Engineers after Mitchell learned to adapt the process to oil-bearing rock. The U.S. is now the world's largest producer of natural gas and is on track to overtake Saudi Arabia as the world's biggest oil producer by the end of the decade, according to the International Energy Agency. The fracking boom sent natural gas prices plummeting, reducing energy costs for U.S. consumers and businesses. And by boosting U.S. oil production, it has sharply reduced oil imports. Electric utilities used more natural gas to generate power because of its low price, while reducing the use of coal. This has led to a substantial reduction in emissions of carbon dioxide and toxic chemicals such as mercury by U.S. utilities.

But the practice has also sparked powerful antagonism, especially in the Northeast, from residents and environmentalists opposed to increased industrial activity in rural areas and concerned that the fracking process or the wastewater it generates can contaminate drinking water supplies.

That shale has changed the oil landscape of the US would be a gross understatement. In fact, the present energy revolution in the US is mainly due to shale... Oil Shale is nothing but a type of sedimentary oil bearing rock with low permeability which contains a mixture of natural gas and liquids including oil (Shale oil). It's controversial as the extraction process, fracking, is harmful to the environment. There's also the looming fear of induced earthquakes because of fracking.

Fracking is the method used to extract gas from the shale formations. A hole is drilled into the rock and a mixture of sand, chemicals and water are injected at high pressure. Under the impact, the rock splits releasing the gas. Irrespective of popular opinion, extracting shale is expensive. But, what wasn't possible a decade ago is happening today not only because of technological advances, but also due to the current price of oil...In the US, Shale oil production is mainly concentrated in Texas and North Dakota. Drilling in the Permian Basin and the Eagle Ford shale formation has enabled oil production in Texas to grow from 31,661,000 barrels per month in September 2008 to 61,500,000 barrels per month in September 2012. Oil production in North Dakota is mainly from the Bakken shale formation. According to estimates of the US Geological Survey there are about 4.3 billion barrels of recoverable oil in Bakken and drilling in this formation has helped North Dakota's oil production to shoot by more than 250,000 barrels per day (between September 2011 and September 2012).

The IEA predicts the US to overtake Saudi Arabia and Russia as the world's biggest producer of oil by 2017. Also, on the anvil: US becoming self-sufficient in oil by 2035 and North America trudging on to become a net oil exporter sometime around the year 2030. Exxon Mobil Corp.'s annual outlook, for its part, expects North America as an exporter of oil and gas 'by the middle of the next decade.' Both these reports, if you care, are closely monitored by oil investors...

Of course, talking about energy, it's not only shale, there's the Canadian Oil sands or tar sands too. Like Shale, this unconventional oil reached people only after the dramatic price rise in oil. In fact, compared to a conventional oil well, the extraction of these sands is about twelve percent dirtier, not to mention the pristine forests destroyed. If the Keystone XL pipeline manages to transport this oil to the Texas refineries, it would be a victory to the oil pundits at the expense of the environment. The Canadian tar sands produce about 1.5 million barrels a day, most of them coming from the Alberta oil fields. As a result, Canada is rather over-enthusiastic for pipelines to conduit the excess oil.American Oil Revolution (OilPrice)

Tight oil is expensive and polluting, but if the prices of oil are high enough, there is enough of the stuff to keep the oil age limping along. But for the first time, people realized that the cheap, easy-to-get oil was no longer increasing. The problem was that oil needed to be expensive for fracking to be viable, but expensive oil hurt the economy, and hence, reduced demand. Also, unconventional oil sources were not only more expensive to get at, but more difficult to refine, meaning that new supply cannot be brought to market fast enough to smooth over price swings without Saudi Arabia's easily accessible and refined oil, which could enter the market quickly. Tar sands, for example, have no "flow rate" since there is no flow. Production cannot increase quickly.

Some analysts, however, believe that tight oil is just hype. They point to the massive capital expenditures needed to keep the wells going, and the very fast depletion rates. New wells need to constantly be drilled because of this, they argue. And even though U.S. oil production is increasing for the first time since the 1970's, it will be short lived. Here's Arthur Berman:

Arthur Berman: First of all, I’m not sure that the premise of the question is correct. Who said that technology is responsible for increasing production? Higher price has led to drilling more wells. That has increased production. It’s true that many of these wells were drilled using advances in technology like horizontal drilling and hydraulic fracturing but these weren’t free. Has the unit cost of a barrel of oil gas gone down in recent years? No, it has gone up. That’s why the price of oil is such a big deal right now.The Real Cause of Low Oil Prices (Naked Capitalism)

Domestic oil prices were below about $30/barrel until 2004 and companies made enough money to stay in business. WTI averaged about $97/barrel from 2011 until August of 2014. That’s when we saw the tight oil boom. I would say that technology followed price and that price was the driver. Now that prices are low, all the technology in the world won’t stop falling production.

Many people think that the resurgence of U.S. oil production shows that Peak Oil was wrong. Peak oil doesn’t mean that we are running out of oil. It simply means that once conventional oil production begins to decline, future supply will have to come from more difficult sources that will be more expensive or of lower quality or both. This means production from deep water, shale and heavy oil. It seems to me that Peak Oil predictions are right on track.

Technology will not reduce the break-even price of oil. The cost of technology requires high oil prices. The companies involved in these plays never stop singing the praises of their increasing efficiency through technology—this has been a constant litany since about 2007—but we never see those improvements reflected in their financial statements. I don’t doubt that the companies learn and get better at things like drilling time but other costs must be increasing to explain the continued negative cash flow and high debt of most of these companies.

The price of oil will recover. Opinions that it will remain low for a long time do not take into account that all producers need about $100/barrel. The big exporting nations need this price to balance their fiscal budgets. The deep-water, shale and heavy oil producers need $100 oil to make a small profit on their expensive projects. If oil price stays at $80 or lower, only conventional producers will be able to stay in business by ignoring the cost of social overhead to support their regimes. If this happens, global supply will fall and the price will increase above $80/barrel. Only a global economic collapse would permit low oil prices to persist for very long.

Renewables had never gone away, but after the 1980s oil glut, they were sidelined as fossil fuels were too cheap for renewables to be competitive at a large scale. But they continued to be developed, mainly for places where oil couldn't be used like remote areas where photovoltaic panels made more sense.

If solar energy was to become a practical terrestrial source of electricity, the cells needed to be cheaper—much cheaper. One of the pioneers in that effort was a chemist named Peter Varadi. In 1973, he and fellow Hungarian refugee Joseph Lindmayer launched a company called Solarex in Rockville, Md.The Power Revolutions (Daniel Yergin, Wall Street Journal)

When they started, there was hardly a market for photovoltaic cells. Then customers began to emerge, mainly for applications in remote locations, off the grid. The U.S. Coast Guard bought solar cells to power its buoys. The oil industry did the same for offshore platforms. Illicit marijuana producers needed a lot of power for their greenhouses but also wanted to avoid getting fingered by the police because of oversize electric bills.

But it seemed like the solar business would never reach sufficient scale. Solarex was profitable but short of capital, and Dr. Varadi and Dr. Lindmayer ended up selling it in 1983. Exxon, the other early entrant in the field, got out in 1984 because it couldn’t see a significant market ahead in any reasonable time frame. By the beginning of the 1990s, the Economist was calling the solar industry “a commercial graveyard for ecologically minded dreamers.” For struggling solar (and wind) entrepreneurs, the decade became known as the “valley of death.”

But then, at the beginning of this century, solar came back to life. The reason was Germany. In pursuit of a low-carbon future, the country launched its Energiewende (energy transition), which provided rich subsidies for renewable electricity.

The biggest beneficiary of Germany’s solar policy turned out to be not German industry, as had been expected, but China. Chinese companies rapidly built up low-cost manufacturing facilities and captured the German market, driving Q-Cells, the leading German company, into bankruptcy.

The resulting overcapacity of Chinese factories pushed down costs, as did the falling price of silicon, the raw material that goes into solar cells. As a result, the cost of a solar cell has fallen by as much as 85% since 2006. Installation costs have also come down, though not to the same extent.

But what really pushed renewables to the forefront was a new wrinkle in the story. As far back as the late 1800's, scientists had speculated that increasing carbon in the atmosphere could have an effect on the climate. By the 1970's, it was already known that the burning of carbon was having deliterious climatic effects. The oil companies' own research demonstrated this, but instead they launched a campaign of denialism and misinformation.

...the world is drifting further towards dangerous levels of average temperature rise and runaway climate change; the IEA projects an increase of 3.6 to 5.3 degrees Celsius by the end of the century. Scientists warn this level of warming could threaten civilization as we know it.New IEA Report Calls for Energy Revolution to Avoid Climate Catastrophe (EcoWatch)

In its “4-for-2 degrees Celsius” scenario, the report proposes four near-term “pragmatic and achievable” measures to put the world on track to limiting warming to safer levels and could reduce emissions by eight percent on levels otherwise expected by 2020 without harming economic growth.

Targeted energy efficiency measures in buildings, industry and transport would account for nearly half of these savings by 2020 while limiting the construction and use of the least-efficient coal-fired power plants could deliver another 20 percent of these savings—while helping to curb local air pollution. The report estimated renewable energy generation would increase from around 20 percent to 27 percent over the same period to fill the void created.

The desire to have non-polluting sources of energy and ones that could not be controlled by foreign countries drove the expansion of renewables before 2008, but now they were actually price-competitive with fossil fuels due to high prices. Photovoltaic panels are silicon-based, so they fall in price like computer chips. That is, the marginal cost to produce another one goes down over time. In contrast, the marginal cost of extracting each additional barrel of oil goes up, so there are hopes that renewables will outcompete fossil fuels in the market and reduce demand to the point where oil demand stays constant even as energy increases.

This graph shows why solar power will take over the world (Treehugger)

The recession, however, continued to grind on. It was the same dynamic as the 1970s - when oil prices spike, the economy goes into recession lowering oil demand. Economic activity is curtailed, businesses close their doors, employees are laid off and don't drive to work, people don't take vacations, etc. Demand goes down and oil supplies are less tight, leading to lower prices. It's the same dynamic over and over again.

In order to stimulate the economy, the Federal Reserve typically lowers interest rates. But interest rates had been low thought the 2000s, contributing to the housing bubble and the financialization of the economy. They were now lowered to essentially zero (ZIRP - Zero Interest Rate Policy). We know that more money is created when new loans are taken out. The idea is to create additional money to offset imaginary credit destroyed during the financial crisis which had financed the bubble.

This led to fears of 'debasing" the currency. Every country wants to make its currency weak to make its exports cheaper and to drive up demand for its currency. Nobody wants the "strong" currency in an economy like this one. Thus, there is no loss of confidence and flight from the dollar into safe currencies on the part of the investor class, because there are no safe currencies.

The problem is, once central banks set interest rates at essentially zero, there is little else they can do. Just like a volume knob, it cannot go below zero. Rather than "stimulate" the economy, The increased money has gone into speculation, into corporate cash hoarding, into offshore accounts, and into real estate, driving prices in major cities into the stratosphere and pricing out ordinary people. the gap between the rich and the poor has soared to the greatest level ever seen. While addition money printing via "keystrokes" caused angst in certain Neoliberal quarters, the Federal Reserve was now doing something unthinkable in the 1970's - trying to prevent deflation, that is, dollar being worth more over time causing people to hoard money.

Quantitative easing has made the rich richer and driven up asset prices. It hasn't done much to help ordinary people, however. "The current form of QE is merely an asset swap: dollars for existing financial assets (federal securities or mortgage-backed securities). The rich are getting richer from bank bailouts and very low interest rates, but the money is not going into the real economy, which remains starved of the funds necessary to create the demand that would create jobs." (source). For ordinary people without assets, stocks or bonds, they get "austerity."

"Austerity" is a key policy from Neoliberal disaster capitalism. It declares that governments cannot have a debt to GDP ratio over a certain amount, and if they do, they must balance their budgets by reducing social spending, increasing user fees, firing government employees, ending pensions, selling off common-pool assets, etc. It was the same playbook used against New York in the Seventies, throughout Latin America in the Eighties, and the developing world in the Nineties. Now, the debt crisis had come home to the Western Industrialized countries - Europe, Japan and the United States.

Austerity was embraced by political and economic elites. But austerity is self-defeating. As governments tighten their belts, the private sector has less money to spend, driving demand down even further. The crippled economy cannot generate sufficient tax revenues to balance the budget, so the cycle begins anew causing economic contraction and hardship. Often widespread hardship lesds to political instability.

In addition, labor, having been crushed in the past 25 years, could not earn enough to buy what the economy was producing. Capitalism depended on colonizing new emerging markets to sell to, sort of a Ponzi dynamic, but that appears to have run its course. The typical male U.S. worker earned less in 2014 than in 1973 (Wall Street Journal). With governments unable to spend and consumers unable to spend, the economy continued to deteriorate. As it deteriorates, revenues decline, exacerbating the crisis. Even lowered oil prices giving theoretical boosts to consumer spending have had little stimulative effect so far.

With energy prices increasing and a youth bubble played out, sufficient growth rates to pay off debt appear unlikely. Rather than write off debts, the banking establishment insisted on being paid in full. Greece's "public" debt was caused by paying back German banks after the crash. It was exacerbated by the use of the Euro, whose behavior is not controlled by a central bank of Greece and can not be adjusted to suit the needs of that country due to it being yoked to many other countries. The Euro is a one-size-fits-all model for vastly disparate economies. Greece plunged into a crisis worse that the Great Depression of the 1930's. Other European economies suffered too.

The response to this financial crisis was markedly different from that of the Great Depression of the 1930's. In the Keynesian concept, when demand is suppressed, the government can go into deficit by injecting money directly into the economy giving unemployed people work and businesses more revenue (it is the private sector which government hires to do its business). As their spending and confidence increases, the underutilized capacity is once again realized.

Neoliberalism, which portrays governments as the enemy of the free market, balanced budgets as sacrosanct, and markets as self-correcting and heading toward equilibrium, would have egg on its face if governments were required to make the system work. It would acknowledge the role of the government to make the free market work for all, a concept that the wealthy and powerful had been determined to suppress since the Powell Memorandum.

The corporations who backed Neoliberalism are deeply, deeply afraid of Keynesian economics coming back after tree decades of Neoliberalism. It's easy to see why. The Keynesian consensus and the attitudes toward capitalism in the aftermath of the Great Depression and the War led to thirty years of increasing wages for labor and decreasing fortunes for the one percent. They do not want to go back to that. They will do anything to make sure that does not happen again, and now they own the media.

Slandering the 70s (Paul Krugman)

And that's just Keynesian capitalism, not Marxism, or other more radical critiques of the system. Potential problems with capitalism are too numerous to go into, but they include declining populations, resource limits, climate change, mass automation, "secular stagnation," a slowdown in innovation, government corruption, extreme inequality, debt crises, and so on. Increasing stock market values are caused by speculation and gaming the system, rather than additional production.

The troubles in the oil patch are mainly attributable to the Fed’s easy money policies. By dropping rates to zero and flooding the markets with liquidity, the Fed made it possible for every Tom, Dick and Harry to borrow in the bond market regardless of the quality of the debt. No one figured that the bottom would drop out leaving an entire sector high and dry. Everyone thought the all-powerful Fed could print its way out of any mess. After last week’s bloodbath, however, they’re not nearly as confident. Here’s how Bloomberg sums it up:

“The danger of stimulus-induced bubbles is starting to play out in the market for energy-company debt…Since early 2010, energy producers have raised $550 billion of new bonds and loans as the Federal Reserve held borrowing costs near zero, according to Deutsche Bank AG. With oil prices plunging, investors are questioning the ability of some issuers to meet their debt obligations…

The Fed’s decision to keep benchmark interest rates at record lows for six years has encouraged investors to funnel cash into speculative-grade securities to generate returns, raising concern that risks were being overlooked. A report from Moody’s Investors Service this week found that investor protections in corporate debt are at an all-time low, while average yields on junk bonds were recently lower than what investment-grade companies were paying before the credit crisis.”

The Fed’s role in this debacle couldn’t be clearer. Investors piled into these dodgy debt-instruments because they thought Bernanke had their back and would intervene at the first sign of trouble. Now that the bubble has burst and the losses are piling up, the Fed is nowhere to be seen.The Oil Coup (Center for Research on Globalization)

In the last week, falling oil prices have started to impact the credit markets where investors are ditching debt on anything that looks at all shaky. The signs of contagion are already apparent and likely to get worse. Investors fear that if they don’t hit the “sell” button now, they won’t be able to find a buyer later. In other words, liquidity is drying up fast which is accelerating the rate of decline. Naturally, this has affected US Treasuries which are still seen as “risk free”. As investors increasingly load up on USTs, long-term yields have been pounded into the ground like a tentpeg. As of Friday, the benchmark 10-year Treasury checked in at a miniscule 2.08 percent, the kind of reading one would expect in the middle of a Depression.

The Saudi-led insurgency has reversed the direction of the market, put global stocks into a nosedive and triggered a panic in the credit markets. And while the financial system edges closer to a full-blown crisis every day, policymakers in Washington have remained resolutely silent on the issue, never uttering as much as a peep of protest for a Saudi policy that can only be described as a deliberate act of financial terrorism.

The other major story since 1970 has been the rise of China. The corporations of the world have relied on China for the cheap labor that they used to crush the working classes of the developed world. They've also relied upon "emerging markets" to sell the goods that Western consumers can no longer afford to buy. Cheap Chinese good have kept inflation low.

China's resource use is staggering. It is the world's most populous country. In 2014 by some measures it passed the United States as the world's largest. Even if demand fell in the United States, demand from China would keep demand for oil high, a situation very different from the 1970's. China passed the United states as the world's largest oil importer in April of this year (2015). China is now the world's factory floor, and feeding the Chinese industrial machine keeps commodity producers in business and feeds the world's growth. China's growing "middle class" is touted even as living standards in the developed countries continuously fell during this period:

Over the last 20 years, the world economy has relied on the Chinese economic growth engine more than it would like to admit. The 1.4 billion people living in the world’s most populous country account for 13% of global GDP, which is significant no matter how it is interpreted. However, in the commodity sector, China has another magnitude of importance. The fact is that China consumes mind-bending amounts of materials, energy, and food. That’s why the prospect of slowing Chinese growth is likely to continue as a source of nightmares for investors focused on the commodity sector.

The country consumes a big proportion of the world’s materials used in infrastructure. It consumes 54% of aluminum, 48% of copper, 50% of nickel, 45% of all steel, and 60% of concrete. In fact, the country has consumed more concrete in the last three years than the United States did in all of the 20th century.China Consumes Mind-Boggling Amounts of Raw Materials (Visual Capitalist)

China is also prolific in accumulating precious metals – the country buys or mines 23% of gold and 15% of the world’s silver supply.

With many mouths to feed, China also needs large amounts of food. About 30% of rice, 22% of corn, and 17% of wheat gets eaten by the Chinese.

Lastly, the country is no hack in terms of burning fuel either. Notably, China uses 49% of coal for power generation as well as metallurgical processes in making steel. It also uses 13% of the world’s uranium and 12% of all oil.

China's economic miracle (BBC)

Globalization also slowed down due to high oil prices. World trade appears to have peaked in 2008:

The “great trade collapse” occurred between the third quarter of 2008 and the second quarter of 2009. Signs are that it has ended and recovery has begun, but it was huge – the steepest fall of world trade in recorded history and the deepest fall since the Great Depression. The drop was sudden, severe, and synchronised. A few facts justify the label: The Great Trade Collapse.The great trade collapse: What caused it and what does it mean? (Vox EU)

The latest World Trade Monitor showed the volume of world trade falling in May by 1.2 per cent. It slid in four out of five months in 2015 and risen just 1.5 per cent in the past 12 months — less than the growth in global output and far below the long-term average of about 7 per cent a year.

The problem has been getting worse for some time. Trade bounced back fairly well in 2010 after the global recession but it has disappointed ever since, growing by barely 3 per cent in 2012 and 2013. Now it seems the world cannot manage even that.The world trade slowdown continues, and worsens (Marginal Revolution)

In the years since the crisis, oil prices have come down dramatically, to the point where oil is allegedly "cheap" and plentiful again. Early on, the slower demand was due to the recession, which "officially" ended in 2012. But the drop in prices since then has less to do with shale oil and more to do with the Saudis abandoning their role in managing the oil market. The Saudis learned the undesirable (from their standpoint) effects of high-priced oil from the seventies and are determined to not let it happen again. The goal is threefold 1.) To keep oil cheap enough to avoid destruction of demand. 2.) To avoid the use of substitutes such as natural gas and renewables like wind, tidal, geothermal and solar. 3.) To shut down the unconventional oil producers in North America and take back market share from high-cost producers like Norway and Canada. Personally, I think the Saudis are terrified of the electirifcation of the world's vehicle fleet, the largest source of global oil demand.

...[F]rom mid-September to the middle of November, while benchmark crude prices plunged 21 percent to a four-year low, [Ali al-Naimi, Saudi Arabia’s petroleum minister and the world’s de facto energy czar] didn’t utter a word in public...Twice during previous routs—amid the Asian financial crisis in 1998 and again when the global economy melted down 10 years later—Naimi reversed oil’s free fall by orchestrating production cutbacks among members of OPEC. This time, he went to ground.

At the cartel’s semiannual meeting on Nov. 27 in Vienna, Naimi shot down proposed output reductions supported by a majority of the 12 members in favor of a more daring strategy: keep pumping and wait for lower prices to force high-cost suppliers out of the market. Oil prices fell a further 10 percent by the end of the next day and kept going. Having averaged $110 a barrel from 2011 through the middle of 2014, Brent crude, the global benchmark, dipped below $50 in January.

“What they did was historic,” Daniel Yergin, the pre-eminent historian of the oil industry, told Bloomberg in February. “They said: ‘We resign. We quit. We’re no longer going to be the manager of the market. Let the market manage the market.’ That’s when you got this sort of shocked reaction that took prices down to those levels we saw.”

Naimi, 79,...told his OPEC counterparts they should maintain output to protect market share from rising supplies of U.S. shale oil, which costs more to get out of the ground and thus becomes less viable as prices fall. In December, he said much the same thing in a press interview, arguing that it was “crooked logic” for low-cost producers such as Saudi Arabia to pump less to balance the market.

Supply was only half the calculus, though. While the new Saudi stance was being trumpeted as a war on shale, Naimi’s not-so-invisible hand pushing prices lower also addressed an even deeper Saudi fear: flagging long-term demand.Saudi Arabia's Plan to Extend the Age of Oil (Bloomberg)

U.S. State Department cables released by WikiLeaks show that the Saudis’ interest in prolonging the world’s dependence on oil dates back at least a decade...“Saudi officials are very concerned that a climate change treaty would significantly reduce their income,” James Smith, the U.S. ambassador to Riyadh, wrote in a 2010 memo to U.S. Energy Secretary Steven Chu. “Effectively, peak oil arguments have been replaced by peak demand."...Before oil prices tanked last year, Saudi officials were bracing for global demand to level off as soon as 2025... By letting prices fall, they may have bought themselves some time. At $60 to $70 a barrel, peak demand gets pushed back at least five more years,..Such a delay would be bad news for renewable energy companies and for anyone hoping to bend the demand curve lower—slowing or stopping the relentless rise of global oil consumption that has transformed the planet since the first commercial deposit was developed in Pennsylvania in the early 1860s.

Crude prices above $100 a barrel had been bringing a demand peak closer. ..Saudi officials were in a state of “near panic” last summer, when they recognized how quickly demand growth in China was leveling off, in part because of persistently high crude prices...

While the latest 25 percent slide in oil prices to below $90 a barrel is so far modest compared with the 1980s slump that took crude from $35 to below $10, many observers see similarities in a global market that is on the brink of a pivotal turn from an era of scarcity to one of abundance.

Three decades ago, the spike in prices caused by the 1973 Arab oil embargo and Iran's 1979 revolution sapped global oil demand, while the discovery of oil offshore in the North Sea spurred a new influx of non-OPEC crude. With world markets awash in oil, Saudi Arabia embarked on a strategy of defending prices, which at the time were largely set by exporters rather than the nascent futures market. The kingdom slashed its own output from more than 10 million barrels per day in 1980 to less than 2.5 million bpd in 1985-86.

Other producers failed to follow suit, however, both within the Organization of the Petroleum Exporting Countries and among new petroleum powers such as Britain and Norway. Prices fell into a years-long slump, leading to 16 years of Saudi budget deficits that left the country deeply in debt.

Finally, in 1985, Riyadh shifted gears, revving up output and cutting prices in a move that triggered a final slump in markets but ultimately paved the way for a gradual recovery. "The big mistake was that they continued to cut production to try to prop the prices and the price fell anyway," said analyst Yasser Elguindi of Medley Global Advisors. Instead they should have fought for market share, allowing "higher cost producers to shut in as the price fell - which is what they are doing now.”

Last week, Saudi officials briefed oil market participants in New York on the kingdom's shift in policy, making clear for the first time that Saudi is prepared to tolerate a period of lower prices - perhaps as low as $80 a barrel - in order to retain market share, Reuters reported on Monday.Facing new oil glut, Saudis avoid 1980s mistakes to halt price slide (Reuters)

In the 1980s, it was a drop in U.S. and European consumption coupled with the rise of the North Sea; now it is fears of easing demand from Asia and the unexpected growth of U.S. shale oil. The net effect is the same: An oil market potentially facing years worth of oversupply, a scenario the Saudis and OPEC have not been forced to grapple with since the early 2000s, before the rise of China triggered a decade-long price boom.

During the 1980s, Riyadh learned the hard way that it could not count on fellow OPEC producers, many of whom continued to pump at higher rates than their agreed-upon quotas, leaving Saudi Arabia to bear the brunt of output cuts.

Much of the disharmony was on public display. Iran and Iraq were engaged in an eight-year all-out war. Accusations by Iraq that Kuwait had been pumping above its OPEC quota led ultimately to the first Gulf War in the early 1990s. It was not until late 1985 that the issue came to a head. The kingdom and OPEC finally agreed to reclaim market share, driving prices down to $10 a barrel but reestablishing themselves in the market. It took 16 years for prices to fully recover.

This time around, Riyadh appears to be taking that stance from the start, with a focus on preserving the medium-term revenue of its 266 billion barrels of crude oil reserves rather than chase falling prices and sacrifice their market. "From an economics point of view, it’s much better to let prices go way down," according to Philip K. Verleger, president of consultancy PKVerleger LLC and a former advisor to President Carter. The emerging price war is "a war of necessity."

The last thing the Saudis want is a serious attempt to reduce oil demand and get serious about a less oil dependent, non-carbon economy. It should be noted that the Saudis are major investors in FOX News, which is pretty much controls the Republican party. That explains much of their anti climate stance and "drill baby drill" rhetoric."We have a strategic alliance with Rupert Murdoch for sure and I have been with him for the last 15 or 20 years," [Saudi Prince Alwaleed bin Talal] said. "My backing of Rupert Murdoch is definitely unwavering." (source)

OPEC is looking for a longer-lasting impact on other high-cost production oil field plans, many in deep oceans, with bigger time scales, even if that means a period of cheap oil prices lasting for years. Privately, OPEC's core Gulf members say they have resigned themselves to the idea that the U.S. shale industry's high-tech flexibility means it will respond quickly when prices start rising again, making the United States the new swing producer in world oil, the role held for so long by Saudi Arabia...OPEC focuses on rival mega projects, lives with shale swing output (Reuters)

"Shale will be a new swing producer of sorts," said Yasser Elguindi of economic consultants Medley Global Advisors. "Because of its shorter investment cycle, when prices fall shale producers will be the ones to cut first, but likewise when prices go up, they will also be the first to bring up production. The drop in oil prices has forced companies to free up capital to help balance their books at the expense of allocating cash to expensive new projects. In some cases, investment decisions have been delayed to allow more time to reset cost structures on projects.

Companies such as BP, Total and Norway's Statoil have postponed projects ranging from the Gulf of Mexico to the UK North Sea, Nigeria and Indonesia and dozens of other projects would be also likely delayed, according to Norwegian consultancy Rystad Energy. Consultancy Wood Mackenzie estimated around 10.6 billion barrels of oil equivalent potentially retrievable from deep and ultra-deep offshore projects has been deferred, followed by 5.6 billion barrels trapped in oil sands.

In its new medium-term forecast, OPEC sees oil prices rising by no more than $5 a barrel a year to reach $80 by 2020, with higher demand for the group's oil and lower supplies from other non-OPEC producers..."Next year the oversupply will put pressure on prices, and that's why no one is expecting $100 (a barrel) till 2040," said one OPEC source.

Meanwhile, the Middle East and Afghanistan continue to go up in flames:

Many of the countries most threatened by the onslaught of the extremist group [ISIL], which has grown out of the chaos of Syria but was initially dismissed as a wider threat to regional stability, will gather at the end of this week in Vienna for the meetings of the Organisation of the Petroleum Exporting Countries (Opec).

Iraq, Saudi Arabia, the Gulf states and Iraq – which together account for two thirds of the cartel's production – are all now affected by the inexorable march of the Isil jihadists but appear powerless to prevent it due to the widening sectarian schism between the Sunni and Shia Muslims across the region in the wake of the Arab spring uprisings five years ago.ISIS is Making the Biggest Threat to Oil Prices Even Worse (Business Insider)

This has sent waves of refugees from the crisis into Europe, a crisis which is still ongoing. Europe is currently seeing the greatest wave of refugees since the second world war. Low oil prices are wreaking havoc on the middle east including the "Fragile Five:"

There are several countries in which the risks are the greatest – Algeria, Iraq, Libya, Nigeria, and Venezuela – and RBC Capital Markets has labeled them the “Fragile Five.”

Iraq, facing instability from the ongoing fight with ISIS, has seen its problems compounded by the fall in oil prices, causing its budget to shrink significantly. The government is moving to tap the bond markets for the first time in years, looking to issue $6 billion in new debt. ..with Brent crude now dropping well below $50 per barrel, Iraq’s finances are worsening. According to Fitch Ratings, Iraq may post a fiscal deficit in excess of 10 percent this year, and all the savings accrued during the years of high oil prices have been depleted.

Low oil prices could also push Venezuela into a deeper crisis. The cost of insuring Venezuelan government bonds has hit its highest level in 12 years, indicating the growing probability of default. Critical parliamentary elections loom in December, but the government has already cracked down on opposition candidates and will likely prevent a fair election from taking place, even while President Maduro’s popularity sinks. The economy is already in crisis, but it is teetering on the brink of something more acute. Bloomberg’s editors openly wonder whether Venezuela’s neighbors are prepared for its collapse.

For Libya, already torn apart by civil war and the growing presence of ISIS militants, low oil prices are the last thing the country needs. ISIS violently crushed a civilian rebellion last week in the coastal city of Sirte, according to Al-Jazeera. Libya’s internationally-recognized government has called upon Arab states for help in fighting ISIS, something that the Arab League has endorsed. Meanwhile, the country’s oil sector – the backbone of the economy – is producing less than 400,000 barrels per day, well below the 1.6 million barrels per day Libya produced during the Gaddafi era. In other words, Libya is selling far less oil than it used to, and at prices far below what they were as recently as last year.

Saudi Arabia does not belong in the same category of troubled countries, but it is also not immune to oil prices at multiyear lows, despite its vast reserves of foreign exchange. Saudi Arabia could run a fiscal deficit that is equivalent to about 20 percent of GDP.Low Oil Prices Could Break The “Fragile Five” Producing Nations (OilPrice)

And now China, the growth engine of the world, appears to be slowing down:

China is the world's biggest importer of crude oil.It took top spot in April this year and even before that was behind only the United Sates. Slower economic growth in China means less demand for oil than there would otherwise have been. Of course there are other factors behind the oil price collapse of the last year, some of them leading to abundant supplies. The rise of shale oil in the United States and Saudi Arabia's unwillingness to respond by curbing its own output have also put pressure on the oil price. But demand is an important element.The Future:

And just look at what the impact of all these factors has been. The price of Brent crude oil roughly halved in the second six months of last year. It recovered a bit and then fell by nearly 40% from the level it reached at about the same time (in June) that the Chinese stock market began its sharp decline. That's not to say the Chinese stock market is directly responsible for oil's fall. But it has reinforced concerns about whether China's economic growth is going to slow very abruptly, and has undermined expectations about future oil sales - driving down the price now.

Cheaper oil is a great boon for struggling economies that have to import the stuff. ...But it is an increasingly serious problem, certainly economically and perhaps politically too, for oil-exporting countries. Oil accounts for a very large share of government revenue in many countries. The IMF says it's more than half for many oil exporters and as high as 80-90% in some, including Iraq, Qatar, Oman and Equatorial Guinea.

The IMF has also estimated the oil price it would take for some countries in the Middle East and North Africa (and a couple in the former Soviet Union) to balance their government budgets. For all of them that "breakeven" price is higher than today's level. For several, including Saudi Arabia and Iran it would take a lot more than double what it is now to balance the budget. For Libya it is more than $200 a barrel, higher than the oil price has ever been.

The state has had a central role in the economic life of many countries across the Middle East and North Africa. It has been called a social contract. The World Bank said: "The old development model - or social contract - where the state provided free health and education, subsidized food and fuel, and jobs in the public sector, has reached its limits." ...The limits on this social contract were a key factor behind the political turmoil known as the Arab Spring. And many of the big oil exporters in the region are relatively authoritarian political regimes. Rising living standards and public services funded by oil revenue play an important part in the political balance in countries such as Saudi Arabia.

Venezuela is another stark case. It has the world's largest oil reserves, although a large part is in the form of very heavy oil that is expensive to refine. The country had acute economic problems even before the oil price drop. The government's finances have been in deficit to the tune of more than 10% of national income or GDP since 2010, and this year the IMF has forecast a figure of 20%. The IMF is also forecasting an economic contraction of 7% and inflation of more than 1,000% - that means prices increasing more than tenfold in a year...There have been protests against President Nicolas Maduro, in what has been called "a deepening political crisis… leading to civil violence and potential regional instability".

Russia is another big oil producer, which has reserves to draw on. It too has an inflation and economic contraction problem, though not on Venezuela's scale. A key factor there has been the low oil price driving down the value of the rouble which makes imports more expensive.

Iran is a rather different story. Of course a high price for oil exports would be helpful. But the government is hoping for rapid increases in the volume of oil sales if, as it expects, the western sanctions are lifted following the deal on the country's nuclear programme. In fact the resumption of more normal levels of Iranian exports would exacerbate the weakness of the oil price, assuming the market doesn't turn a corner in the meantime. But for Iran, the priority is to regain lost market share.

So what does it all mean? Oil and other fossil fuels underpin all of industrial civilization. Oil is world's major transportation fuel and a lifeblood of the economy, and is likely to remain so. The living standards of today are entirely dependent upon the burning of fossil fuels and a stable climate, one of which is now undermining the other. Fossil fuels have allowed us to exploit raw materials to such an extent that we are running out of them, regardless of how many fossil fuels are left in the ground (for example, fresh water and topsoil). Oil is a finite resource, and we are using it at an industrial scale. To an extent, fossil fuels are fungible - one can substitute for the other. Electrification can be thought of as a sort of substitution - fossil fuels are burned to produce additional electricity instead of refined and used directly. Even renewable energy is in the same category - fossil fuels are burned in the factories to manufacture solar panels and windmills instead of creating electricity or used in transportation. Technology can be used to access preciously inaccessible supplies, yes, but getting at oil is harder and harder, making it more and more expensive. This ripples through the economy. As oil becomes harder to get at and refine, bottlenecks will become more common.

Fundamentally, what it means is that the massive growth of societies over the past two hundred years is no longer possible. Increasingly it is a "Red Queen" situation - running faster and faster to remain in the same place. "Decoupling" - the idea that growth can occur without growth in energy seems unrealistic. It seems unlikely that the entire world can be brought up to industrial world living standards without substantially increasing the amount of energy consumed. Even if the world economy grew at only one percent, it would double in the lifetime of someone born today (about 70 years). If inflation and population increase without energy consumption, it seems unlikely that real living standards will increase, only decrease. Global per capita energy consumption (the amount used by every single person alive if usage were equal) peaked already in the 1970's.

Here is Arthur Berman's take on the near future:

Arthur Berman: The global energy mix will move increasingly to natural gas and more slowly to renewable energy. Global conventional oil production peaked in 2005-2008. U.S. shale gas production will peak in the next 5 to 7 years but Russia, Iran, Qatar and Turkmenistan have sufficient conventional gas reserves to supply Europe and Asia for several decades. Huge discoveries have been made in the greater Indian Ocean region—Madagascar, offshore India, the Northwest Shelf of Australia and Papua New Guinea. These will provide the world with natural gas for several more decades. Other large finds have been made in the eastern Mediterranean.

There will be challenges as we move from an era of oil- to an era of gas-dominated energy supply. The most serious will be in the transport sector where we are thoroughly reliant on liquid fuels today —mostly gasoline and diesel. Part of the transformation will be electric transport using natural gas to generate the power. Increasingly, LNG will be a factor especially in regions that lack indigenous gas supply or where that supply will be depleted in the medium term and no alternative pipeline supply is available like in North America.

Of course, natural gas and renewable energy go hand-in-hand. Since renewable energy—primarily solar and wind—are intermittent, natural gas backup or base-load is necessary. I think that extreme views on either side of the renewable energy issue will have to moderate. On the one hand, renewable advocates are unrealistic about how quickly and easily the world can get off of fossil fuels. On the other hand, fossil fuel advocates ignore the fact that government is already on board with renewables and that, despite the economic issues that they raise, renewables are going to move forward albeit at considerable cost.

Time is rarely considered adequately. Renewable energy accounts for a little more than 2% of U.S. total energy consumption. No matter how much people want to replace fossil fuel with renewable energy, we cannot go from 2% to 20% or 30% in less than a decade no matter how aggressively we support or even mandate its use. In order to get to 50% or more of primary energy supply from renewable sources it will take decades.The Real Cause of Low Oil Prices (Naked Capitalism)

It will also mean a radical shift in the economy. Neoliberalism, the free market fundamentalism paradigm that is the dominant economic ideology since the 1980's, is destabilizing the world. Gaps between rich and poor are enormous, and the wealthy are engaged in a zero-sum seizing of the world's assets as profit centers in a world where genuine investment opportunities have dried up. There seems to be a pushback from below, whether it is Occupy Wall Street, Syriza in Greece, or the support for candidates like Bernie Sanders and Jeremy Corbyn. As economist Richard Smith explains, there can never be a "sustainable" capitalism, as growth is an absolute requirement:

As Smith shows, the problem isn't that we are "addicted to growth" or that perpetual growth is a "spell," as Bill McKibben put it (and Smith cites). Even Naomi Klein's important book, This Changes Everything: Capitalism vs. the Climate, which Smith critiques in Chapter 4, focuses largely on "unregulated capitalism" as opposed to capitalism. Consider also the obsession with neoliberalism by so many writers in the mainstream progressive media, who rarely if ever indict capitalism without a preceding adjective. The villains for them are "corporate capitalism," "casino capitalism," etc., rather than capitalism itself.Capitalism, Green or Otherwise, Is ''Ecological Suicide'' (Truthout)

In sharp contrast and with refreshing clarity of thought, Smith explains, "why ecologically suicidal growth is built into the nature of any conceivable capitalism. This means ... that the project of a steady-state capitalism is impossible and a distraction." In particular, "under capitalism, the whole point of using resources efficiently is just to use the saved resources to produce even more commodities, to accelerate the conversion of even more natural resources into products." This cannot be avoided under capitalism without causing economic collapse.

"Insatiable consumerism is an everyday requirement of capitalist reproduction ... No overconsumption, no growth, no jobs." Why no jobs? Consider that "more than two-thirds of market sales and therefore most jobs, depend on direct sales to consumers while most of the rest of the economy including the infrastructure and military is dedicated to propping up this consumerist 'American way of life.' " Even ignoring that, how could capitalism ever achieve a steady state? "Are Toyota or General Motors looking to produce the same number of steel cars next year as this year?" Smith asks.

Similarly in Chapter 3, which bears the same title as the book, Smith demolishes green capitalist hopes through five theses on the nature of any capitalism. The fifth of these directly challenges popular myths of "spells" and addiction to growth:

"Consumerism and overconsumption are not 'disposable' and cannot be exorcised because they are not just 'cultural' or 'habitual.' They are built into capitalism and indispensible for the day-to-day reproduction of corporate producers in a competitive market system in which capitalists, workers, consumers and governments alike are all dependent upon an endless cycle of perpetually increasing consumption to maintain profits, jobs, and tax revenues ..."

In the final two chapters, Smith outlines ecological constraints necessary for any post capitalist economy and describes ecosocialist alternatives to capitalism. The necessary changes are staggering. The entire economy must contract and be restructured with international cooperation. Capitalism is incapable of finding jobs for workers unemployed by degrowth, even though much expansion is needed in social services like health care, education, environmental remediation, etc.

"[S]ince we live under capitalism, not socialism, no one is promising new jobs to all those coal miners, oil drillers, gas frackers, power plant operators, farmers and fertilizer manufacturers, loggers and builders, autobuilders, truck drivers, airplane builders, airline pilots and crews and the countless other occupations whose jobs would be at risk if fossil fuel use were really seriously curtailed."

Smith recognizes that building a movement requires more than being against ecocidal destruction; it requires a vision for the future. To that end he outlines a number of attractive and attainable features of an ecosocialist society.

Here's Chris Martenson giving us the "really really big picture:"

The really big picture goes like this: Humans discovered about 400 million years worth of stored sunlight in the form of coal, oil, and natural gas, and have developed technologies that will essentially see all of that treasure burned up in just 300 to 400 years.The Really, Really Big Picture: There isn't going to be enough net energy (Peak Prosperity)

On the faulty assumption that fossil fuels will always be a resource we could draw upon, we fashioned economic, monetary, and other assorted belief systems based on permanent abundance, plus a species population on track to number around 9 billion souls by 2050.

There are two numbers to keep firmly in mind. The first is 22, and the other is 10. In the past 22 years, half of all of the oil ever burned has been burned. Such is the nature of exponentially increasing demand. And the oil burned in the last 22 years was the easy and cheap stuff discovered 30 to 40 years ago. Which brings us to the number 10.

In every calorie of food that comes to your table are hidden 10 calories of fossil fuels, making modern agriculture and food delivery the first type in history that consumes more energy than it delivers. Someday fossil fuels will be all gone. That day may be far off in the future, but preparing for that day could (and one could argue should) easily require every bit of time we have.

What galls me at this stage is that all of the pronouncements of additional oil being squeezed, fractured, and otherwise expensively coaxed out of the ground are being delivered with the message that there's so much available, there's nothing to worry about (at least, not yet.) The message seems to be that we can just leave those challenges for future people, who we expect to be at least as clever as us, so they'll surely manage just fine.

Instead, the chart above illustrates that on a reasonably significant timeline, the age of fossil fuels will be intense and historically quite short. The real question is not Will it run out? but Where would we like to be, and what should the future look like when it finally runs out? The former question suggests that "maintain the status quo" is the correct response, while the latter question suggests that we had better be investing this once-in-a-species bequeathment very judiciously and wisely.

Energy is vital to our economy and our easy, modern lives. Without energy, there would be no economy. The more expensive our energy is, the more of our economy is dedicated to getting energy instead of other pursuits and activities. Among the various forms of energy, petroleum is the king of transportation fuels and is indispensible to our global economy and way of life.

To what do we owe the recent explosion in technology and living standards? To me the answer is simple: energy...Because a very large proportion of our society was no longer tied up with the time-consuming tasks of growing their own food or building and heating their own shelter, they were free to do other very clever things, like devote their lives to advancing technology.

Like every other organism bestowed with abundant food – in this case, fossil fuels that we have converted into food, mobility, shelter, warmth, and a vast array of consumer goods – we first embarked on a remarkable path of exponential population growth. Along with these assorted freedoms from securing the basics of living, we also fashioned monetary and economic systems that are fully dependent on perpetual exponential growth for their vitality and well-being. These, too, owe their very sustenance to energy.

It bears repeating: Not just energy is important here, but net energy. It's the energy left over after we find and produce energy that is available for society to do all of its complicated and clever things. Not only is the world struggling right now to increase global oil production, but all of the new and unconventional finds offer us dramatically less net energy to use as we wish.

Here's a comment by Reddit user "Erinaceous, "summing up the big picture nicely:

Conventional oil production actually peaked in 2006 and has been declining slightly since that point. Unconventional oil is largely keeping us on the 'oscillating plateau' but many sources consider this to be a short term phenomenon due to the rapid decline rates of tight oil, and geological and capital constraints.

What happens post peak largely depends on what the total decline rates of conventional fields are. Typically an conventional oil field declines at about 6% a but unconventionals and substitution may flatten this out to a long term plateau or mild decline. The IMF released a policy paper on peak oil and considers a 2% a decline an unlikely scenario. However in their model this would produce an unsustainable 800% increase in oil prices. Since the economy could not sustain that price Kumhoff speculates the system would become nonlinear and demand destruction would drive the price down. In the scenario they consider most probable the IMF team projects a doubling of oil prices with the decade. This is close to what other modelling approaches have shown including this one that uses network models to examine sectorial [sic] vulnerabilities.

Other authors expect that because of the lack of easily substitutable at scale alternatives to oil and oil's energetic importance to the economy declining oil production will lead to shrinking discretionary spending. ...Since discretionary spending is what finances new technology and infrastructure this would have a negative effect on transitioning to alternatives (ie. it's hard to buy a $35,000 electric car when you've just been laid off).