For this chapter, I will use the excellent book, The End of Oil by Paul Roberts as a guide.

Last time we saw how oil prices crashed in the 1980's setting up the emergence of Neoliberalism as the predominant theory governing the planet's economy. Oil prices played a role in the collapse of the Soviet Union, the Latin American debt crisis, and the rise of Islamic Fundamentalism in the Middle East.

Starting in the mid-1970s the Islamic resurgence was funded by an abundance of money from Saudi Arabian oil exports. The tens of billions of dollars in "petro-Islam" largess obtained from the recently heightened price of oil funded an estimated "90% of the expenses of the entire faith."State-sponsored terrorism (Wikipedia)

Throughout the Sunni Muslim world, religious institutions for people both young and old, from children's maddrassas to high-level scholarships received Saudi funding, "books, scholarships, fellowships, and mosques" (for example, "more than 1500 mosques were built and paid for with money obtained from public Saudi funds over the last 50 years"), along with training in the Kingdom for the preachers and teachers who went on to teach and work at these universities, schools, mosques, etc. The funding was also used to reward journalists and academics who followed the Saudis' strict interpretation of Islam; and satellite campuses were built around Egypt for Al Azhar, the world's oldest and most influential Islamic university.

The interpretation of Islam promoted by this funding was the strict, conservative Saudi-based Wahhabism or Salafism. In its harshest form it preached that Muslims should not only "always oppose" infidels "in every way," but "hate them for their religion ... for Allah's sake," that democracy "is responsible for all the horrible wars of the 20th century," that Shia and other non-Wahhabi Muslims were "infidels", etc. While this effort has by no means converted all, or even most, Muslims to the Wahhabist interpretation of Islam, it has done much to overwhelm more moderate local interpretations, and has set the Saudi-interpretation of Islam as the "gold standard" of religion in Muslims' minds.

The arrival of the OPEC cartel and the boycotts and revolutions caused oil prices to rise tenfold during the decade of the 1970's. Control over the world's oil supplies now resided with the governments of a handful of countries rather than the oil companies (who nevertheless also benefited from higher oil prices). This created the greatest transfer of wealth in the history of the modern world.

The countries who were the beneficiaries of this windfall changed dramatically, from desert backwaters with small populations to wealthy nations enmeshed in global geopolitics.

Take Sheikh Rashid of Dubai. Dubai is one of what the British called the Trucial States when, in the nineteenth century, they established a military presence in this lightly populated area of desert and salt marshes on the Persian Gulf. Sheikh Rashid, before the oil, had derived his income from the dhows, the wooden sailing ships that called at his customs house, on the way to "reexport"—some said smuggle—gold and silver to India, before the oil—the first strike was not until 1957—Sheikh Rashid feuded with Deira, the rival village across the creek. The weapons used in this feud were the cannons from old ships, some of them hundreds of years old. The cannons were stuffed with rags and pistons from hijacked cars, and since cannonballs were in short supply, a nightly truce after sunset prayers permitted the combatants to comb the battlefields and retrieve the cannon balls.Oil prices are a funny thing. Too high and you slow down the economies you need to sell to, driving demand down. Killing the goose, as it were. If they are low, by contrast, your buyers will use plenty of oil driving around in their SUV's, but you will not make enough revenues. Your budgets will collapse. High oil prices hurt oil-importing nations but help oil-exporting nations. Low oil prices help oil-importing nations, but hurt oil-exporting nations. You need a Goldilocks price.

One day, in the pre-oil era. Sheikh Rashid accepted a dinner invitation across the creek, and then had his men kill off his hosts. In the best Middle Eastern tradition— and not unlike Richard III—he consolidated his victory by marrying the thirteen-year-old daughter of the vanquished ruler of Deira to his brother. The Sheikha Sana, as she is called, is a high-spirited woman who once shot her husband's fourth wife. She says, of her early years, that her experiences made her strong, and she has now built up a thriving taxi fleet. Sheikh Rashid married his daughter, Miriam, to the neighboring Sheikh of Qatar, who lent him the money for a bridge across the creek.

Sheikh Rashid's income is now about $1 billion a year, and no one hunts for cannonballs anymore in Dubai. His in-law, the Sheikh of Qatar, produces more oil and is even richer. In the nineteenth century the British navy sailed the Persian Gulf to protect the routes to India; now their former Persian Gulf wards come to London. Sheikh Rashid's ambassador, Mohammed Mahdi al-Tajir, drove the British press to xenophobic frenzy by purchasing $60 million in English real estate in two years: town houses, country houses, and the centuries-old castles of dukes. "Arabs like beautiful things," he said simply. The British press shuddered deliciously at the new, Mephistophelian image of its visitors. The Daily Mirror warned of "school girls missing after dating Arabs," whisked off to "exclusive restaurants in Rolls Royces."

Paper Money; pp. 187-188

In the 1970'sThe OPEC nations got greedy. The high prices made them rich beyond imagination, while bringing the industrialized nations to their knees. But the thing is, high prices have effects.

1.) When they get high, the demand for oil goes down. People don't drive as much. They don't take a vacation. Construction slows down. Businesses refuse to expand. If people pay more for the gas they absolutely need, they spend less on other things. There is less economic activity overall. This means there is less demand because the economy is shrinking. Even if supply remains constant, decreased demand will lower prices.

2.) Efficiency measures that do not make sense with cheap oil make sense with expensive oil. People buy more efficient cars. Automakers raise the energy efficiency of their designs. People insulate their homes and turn down the thermostats. Tankers move slower to save oil. Businesses seek more efficient ways to do things, and engineers get to work on using energy more efficiently.

3.) Higher prices make alternatives economically viable. This could be renewables like solar and wind. It could mean small-scale ethanol and biodiesel. It can also mean things like electric cars. But it can also mean other fossil fuels like coal and natural gas:

Until the early 1950s, natural gas sold for less than three cents per thousand cubic feet. Drillers looking for oil learned to avoid areas that had been, or were today, deeper than the oil window. Today, natural gas sells for more than $3 per thousand cubic feet. Increasing the price by a factor of one hundred is a morale builder. Suddenly, all those natural-gas-only terrains were profitable targets. The "oil boom" of the early 1980s was actually a gas boom. Kenneth Deffeyes, When Oil Peaked; pp. 98-994.) Higher prices call forth additional production as it becomes more profitable to search for oil elsewhere. This is what happened back in the 1980's. As oil prices went high, it created an incentive to scour the world in non-OPEC countries seeking out new oil fields. Fields that previously would have been too expensive to develop suddenly become viable; the North Sea and Alaska for example. It becomes economically viable to build pipelines to move oil from distant fields that were too distant to develop before.

5.) Higher prices cause you to lose market share. Sell your oil for too much money, and if someone can sell it cheaper they will do so, decreasing your share of the market. Since OPEC was a price-setting cartel, any seller outside of OPEC was free to undercut not only them, but each other.

As OPEC loses market share, so will its individual members. This may cause individual members to want to defect, sewing discord among members and setting off price squabbles. They will try and hide this from other members by doing things like lying about their true reserves, cheating on their production quotas, etc.

All of these factors combined to create the oil glut.

But OPEC's biggest weakness was its profound misapprehension of the mechanics of oil power, particularly the setting of prices. As the owner of the world's cheapest oil, OPEC could easily have used its lower production costs to outsell its rivals, like Russia or Mexico — countries that needed to charge more per barrel to make a profit. Such a low-cost strategy would have let OPE C gain a majority share of the world oil market, while still earning a reasonable price for its oil. To succeed at such a strategy, how ever, OPEC couldn't get too greedy. If cartel members tried to push prices too far up by withholding their own production (and thus tightening world supply), the effects would be disastrous. Importing nations would either turn to non-OPEC suppliers (thus reducing OPEC's precious market share), or they would simply use less oil, either by switching to cheaper fuels, like coal or gas, or by becoming more energy-efficient.

So when oil prices skyrocketed during the 1970s and early 1980s, OPEC would have been wise to pump a little more oil and let prices fall slightly. That way, the cartel would have ensured a long-term market tor oil by reassuring the big consumers, like the United States, Europe, and Japan, that oil was a reliable, economical, long-term energy source. True, OPEC's revenues would have fallen off a bit; but by protecting its market share and its customers, the cartel could have made up any losses later, when prices recovered, as they inevitably would have.

Instead, OPEC did the opposite. Addicted to the higher oil revenues of the 1970s, OPEC members refused to reduce their prices. The high prices acted as a brake on global economies accustomed to cheap energy, and the entirely predictable result was widespread recession. Energy demand fell, and importing nations tried to "wean themselves from "foreign oil. Utilities and other industrial users switched to coal, natural gas, and nuclear power, which were now cheaper. Homeowners began heating with natural gas instead of furnace oil. Governments in the United States, Japan, and Europe, embarking on a crusade for energy conservation, poured billions of dollars into alternative fuels and technologies and forced automakers to build fuel-efficient vehicles. For the first time in nearly a century, oil was losing its allure as the miracle energy source, and the impact was staggering. By 1986, world oil demand had fallen by five million barrels a day.

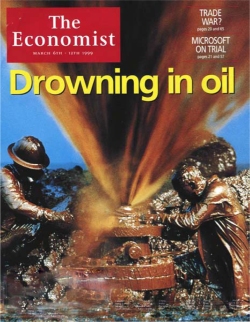

Worse, just as oil demand was falling, a wave of new oil production hit the market. Norway, the United Kingdom, the United States, the Soviet Union, and other non-OPEG countries, whose oil was normally too expensive to compete with OPEC's, now scrambled to take advantage or the high oil prices. Between 1978 and 1986, non-OPEC oil production jumped by fourteen million barrels a day — and most of this increase came at OPEC's expense. Between falling demand for its own oil and rising non-OPEC production, OPEC saw its share of a dwindling market shrink from more than 50 percent to just 29 percent. In retrospect, says one former U.S. State Department official, it is clear that "OPEC [members] had no idea what they were doing. It was totally unrealistic of them to think they could keep prices that high for as long as they did and not have a huge impact on demand."

Desperate to avoid further damage, Saudi Arabia, OPEC's most powerful member, tried enforcing a production limit, or quota, on each member, to reduce supply and shore up prices. But other OPEC members refused. While most saw that cutting production could bring higher prices eventually, in the short term, it would mean an immediate loss of oil income — something no formerly free-spending petrostate could withstand. In Nigeria, desperate oil officials actually cut their prices in an attempt to boost sales and grab back some market share from non-OPEC countries. Mexico, too, lowered its prices.

The Saudis now found themselves in the classic cartel bind: the only way to keep prices high was to cut their own production, as they reluctantly did, letting it fall from lo million barrels a day in 1980 to a mere 2.5 million by 1985. However, this remedy too proved disastrous. Although prices did rise, the Saudi market share was now so tiny that its overall oil revenues remained dangerously low. As the situation worsened, the Saudi royal family felt it had little choice but to turn the "oil weapon" on OPEC itself. Opening its taps, the Saudis flooded the world market with cheap oil.

This first use of "capacity cleansing" was brutal but effective. As price plunged below ten dollars a barrel, Venezuela and other OPEC quota-busters capitulated and cut their production. Saudi Arabia regained its lost market share. Better still, from OPEC's point of view, rival oil operations in high-cost areas like the North Sea and Alaska suddenly became uneconomical, and many were scaled back or even put on hold. These developments hit the Soviet Union, until then the world's largest producer of oil, particularly hard. As falling oil prices cut Moscow's hard-currency income in half, the Soviet oil industry — and the Saudis' biggest oil rival — was knocked out for years.

The End of Oil, pp. 102-103

Now it's important to know that Saudi Arabia's oil is ultra-cheap to produce. Their massive oil fields are under high pressure against the surface rock formation. The oil comes out via wells and does not need to be pumped. Just stick a straw in, as it were. Compare that to the massive offshore oil rigs in the North Sea, for example. Plus, Saudi oil is light crude which is very easy to refine. Only Iraq's oil is cheaper to produce.

Because Saudi oil was so cheap, they could produce it for a price that would drive other countries out of the business. The would "open the spigot" and send oil prices crashing. This would cause expensive oil to no longer be viable and drive other, higher-cost producers out of the market. Saudi Arabia even does this with their own cartel members to enforce discipline. Step out of line and the Saudis will send the prices down screwing up your budgets. It's called "capacity cleansing."

The other thing "opening the spigot" means is that Saudi Arabia can quickly add oil to the market to smooth over price swings. Demand goes up, price gets a bit high, and the Saudis will turn the tap. If it gets too low, they will close the tap.

All these factors are important to understand what is going on today. We will return to them shortly.

In 1989, Iraq's dictator Saddam Hussein had just concluded a costly war with Iran. He needed a high price for his oil to rebuild Iraq. His neighbors, however, did not want Saddam, with his huge military and imperial ambitions, to get more money.

In 1989, having just finished a long and costly war with Iran, Saddam was desperate to sell as much of his oil as he could to replenish his depleted treasury. His neighbors, however, had no interest in seeing Saddam get any richer or stronger. Kuwait in particular feared Saddam and, in an effort to deprive the Iraqi leader of oil revenues, stepped up its own production, intentionally flooding the market and as a result depressing prices. Saddam was not amused. He regarded the Kuwaitis' tactics as tantamount to economic war — he could claim that Kuwait was "stealing" Iraqi oil revenues — and made it clear he would take military action. Too late, the Saudis saw the danger: if Saddam invaded Kuwait, he would probably press on into Saudi Arabia. Desperate to placate the well-armed Iraqi dictator, the Saudis cut their own production and begged Kuwait and other OPEC states to do the same, to push prices back up to twenty-one dollars — high enough, it was hoped, to mollify Saddam and dissuade him from attacking anyone.

The tactic might have worked. Now, however, Venezuela refused to play along. Still reeling from the price collapse of the 1980s — and never terribly interested in Middle Eastern politics — the Venezuelans opened the taps. That move, coupled with similar cheating by United Arab Emirates, effectively destroyed any hope of price appeasement. By 1990, Saddam had massed troops on the Kuwaiti border and, believing the United States to be unwilling to risk a war just for oil, launched his invasion.

The End of Oil, p. 105The Gulf War caused a spike in oil prices. As one would expect, the U.S. went into a short but painful recession. The conservative governments which had ruled since 1980 were finally toppled. Reagan's vice president, George Herbert Walker Bush, was defeated by Democrat Bill Clinton who campaigned on "It's the economy, stupid!" Tony Blair's labor party took over from John Major, Thatcher's successor. However, Clinton was a "third way" politician combining Neoliberal economic policies with slightly more worker friendly attitude and more progressive social policies. In essence, both parties had adopted the Neoliberal economic paradigm. Clinton ran on reducing welfare and making government more efficient. He declared, "The era of big government is over." He repealed the Glass-Steagall act which had been put in place during the Great Depression to regulate the excesses of the banking industry.

The 1970's oil shock and the 1980's oil glut taught a valuable lesson. Rather than mutually assured destruction, stability became the overriding goal. It was the swings in cost, even more than cost per se which screwed up the world economy. Price swings hurt both producers and consumers. A Goldilocks price which would allow for both interests is what was required. Thus a new alliance was formed. The Saudis would arrange price stability as the "swing producer," with the Americans providing the military protection as the preeminent power in the Middle East. The post-Gulf War Era was a golden era of price stability. The economy performed even better than in the 1980's (which people tend to forget). Jobs were plentiful. The internet economy started up (and formed a bubble). Clinton built his "bridge to the 21 century" on low and stable oil prices.

Concerns grew over the stability of the Middle East, however. The Islamic fundamentalism that the Saudis funded and encouraged threatened to destabilize the region. Despite the price stability, America was still an oil importer whose production had peaked in 1970. Saudi Arabia, with it's ailing king and corrupt family of princes, seemed perpetually at risk of implosion from within. Other oil producing nations like Venezuela under Hugo Chavez were openly hostile the the U.S. (prompting a U.S. backed coup attempt in 2006).

In 2000 the Supreme Court appointed George H.W. Bush's son, George W. Bush as president. Bush and his vice president were former oil men, as were many of his advisers and cabinet members. It was as if the oil industry had taken over the government. Islamic terrorism was about take a big bite, however, with the September 11 attacks. Although the attacks were carried out by 15 Saudi Nationals and 4 Egyptians, the Bush administration used it as an excuse to attack Saddam Hussein's Iraq through a campaign of innuendo, misinformation, and outright lies. The invasion, in violation of the UN charter against preemptive war, began on March 20, 2003.

The concept behind the invasion of Iraq is often misunderstood. The real purpose was less to control oil, and more about breaking OPEC. The Neocons believed that the fall of the Soviet Union meant that the only real threat to American hegemony came from Islamic terrorism and OPEC's control over the "oil weapon." Iraq's oil, as we mentioned, is even easier to get at then Saudi Arabia's. There was also a lot of it due to Saddam's mismanagement. If American oil companies could control the Iraqi oil, they could stabilize oil prices without Saudi Arabia's help. They would have their own "spigot" as it were, under America's control. When America took Iraq, the first thing they did was protect the oil wells. In Baghdad, the first building to be secured was the oil ministry. Despite the disruption, Saudi Arabia's "swing" capacity was remarkably able to keep oil prices stable throughout the war.

As far back as 1975, as the Arab oil embargo slowly strangled American economic might, conservative economists and policymakers were searching for ways to defeat OPEC. Although the Nixon administration's plans to take OPEC's Middle Eastern oil fields physically were shelved, the dream of a post-OPEC oil order was kept alive by a cadre of neoconservative American analysts and policymakers — among them, Paul Wolfowitz, now deputy defense secretary, Richard Perle, a top adviser to Defense Secretary Donald Rumsfeld, and, of course, Rumsfeld himself.

In the 1980s, the neocons had supported sanctions against oil sales from Libya and Iran, in hopes of depleting their terrorist budgets — a move that earned them the scorn of big oil companies. A few years later, some neocons began arguing that even Saudi Arabia, that stalwart oil ally, was looking less and less loyal: not only were members of the Saudi royal family reported to have spent five hundred million dollars to export radical Islam, but Riyadh was the ringleader of a pricing regime that was hurting American interests. "For a lot of conservatives, the Middle East, or a significant part of the Middle East, has effectively been at war with the United States ever since the 1970s," says a policy analyst with close ties to the Bush administration. September 11 "was just one final argument that these elements need to be taken care of."

And the key to "taking care" of those elements was Iraq, a country that had at least 150 billion barrels of crude and, except for Saudi Arabia, the cheapest production costs in the world.' Months before the September 11 attacks, when Vice President Cheney (another former oilman) was drawing up a new national energy policy, he and other White House energy strategists had pored over maps of Iraqi oil fields to estimate how much Iraqi oil might be dumped quickly on the market. Before the war, Iraq had been producing 3.5 million barrels a day, and many in the industry and the administration believed that the volume could easily be increased to seven million by 2010. If so — and if Iraq could be convinced to ignore its OPEC quota and start producing at maximum capacity — the flood of new oil would effectively end OPEC's ability to control prices. As supply expanded, prices would fall dramatically, and not even the Saudis with their crying revenue needs would be able to cut production deeply enough to stop the slide. Caught between falling revenues and escalating debts, the Saudis, too, would be forced to open their oil fields to Western oil companies, as would other OPEC countries. The oil markets, free at last from decades of manipulation, would seek a more natural level, which, according to some analysts, would be around fourteen dollars a barrel, or even lower — a price much more conducive to long-term economic growth.

Toppling OPEC wouldn't be easy. Reviving Iraq's moribund oil industry would take massive infusions of capital. By some estimates, it will cost five billion dollars just to resume prewar production levels, and at least forty billion over the long haul. That kind of money could come from only one source — the international oil companies — which would invest in Iraq only if a) Saddam were gone and b) they received some assurance that they would have a share in production revenues and that the market, and not OPEC, would determine production levels.

It is a radical vision. At a stroke, the administration hopes to depoliticize what has for nearly a century been the quintessential political commodity and, in the process, remove the last real obstacle to American power. As Michael Klare, professor of world security studies at Hampshire College, told the Toronto Star last year, in the eyes of the Bush administration, unlocking OPEC oil, "combined with being a decade ahead of everybody else in military technology, will guarantee American supremacy for the next fifty to one hundred years."' Cheney and Rumsfeld "see control of oil as merely part of a much bigger geostrategic vision," argues Chris Toensing, an analyst who works on the Middle East Research and Information Project. "By controlling the Gulf and the Middle East, the United States gains leverage over countries that are more dependent on the Gulf for oil, like China and Europe."

The End of Oil, pp. 111-112The stable oil prices meant that inflation was low or nonexistent. This led to very low interest rates throughout the 1990's and 2000's. Clinton had deregulated wall street. Currencies floated against each other was we saw. The economy had been globalized thanks to the cheap costs of shipping due to improved tankers and cheap oil. All of this caused a massive housing bubble to inflate. As long as housing prices were increasing faster than interest rates, it mad sense to borrow to a buy house and "flip" it to another buyer. Owners could also refinance their homes to come up with extra cash, using their homes as an ATM machine thanks to inflated property values. Corruption reigned in both Washington and Wall Street, but people were doing well, so they looked the other way. Alan Greenspan, a Neoliberal Ayn Rand acolyte and advocate of rational, self-regulating markets, presided over the Federal Reserve.

Post Gulf War 2, things seemed to be going well. The stock market was riding high. House prices were rising. Banks were flush with money. Growth rates were good and "official" unemployment was low. The American worker however, thanks to Neliberalism, has not seen an increase in real wages since 1973.

In the late 1990's and early 2000's a group of retired engineers started to echo M. King Hubbert's warnings from the 1950's. They formed groups like ASPO and argued that the globe as a whole was approaching Peak Oil. The slowdowns of the 1970's had postponed the day of reckoning, but the three decades of cheap oil had led to the abandonment of any alternatives. No new major oil fields had been discovered, and the world was running on supergiant oil fields that had been discovered in the 1940's-1960s which would inevitably decline. Since oil was a global commodity in which exports and imports had to balance, the exporting nations could not make up for countries in decline.

In 2008, gasoline prices spiked, with price almost trebling in eighteen months. In July 2008, oil skyrocketed to $147 a barrel, more than doubling the price of crude over the 12 months to that time. Many thought oil would race past the $150 mark on the way to $200 and to $300 a barrel. This set a new record high in both absolute and inflation-adjusted terms. The economy went into freefall. "This sucker could go down," was George W. Bush's sage pronouncement. Thanks to the fiat money we talked about in part 3, billions of dollars were conjured out of thin air by "keystrokes" to keep the banking industry solvent.

The three developments noted above – growing inequality, a speculative financial sector, and a series of large asset bubbles – account for the long, if not very vigorous, economic expansions in the US economy during 1982-90, 1991-2000, and 2001-07. The rising profits spurred economic expansion while the risk-seeking financial institutions found ways to lend money to hard-pressed families whose wages were stagnating or falling. The resulting debt-fueled consumer spending made long expansions possible despite declining wages and slow growth of government spending. The big asset bubbles provided the collateral enabling families to borrow to pay their bills.Understanding Contemporary Capitalism, Part 1 (Triple Crisis)

However, this process brought trends that were unsustainable in the long-run. The debt of households doubled relative to household income from 1980 to 2007. Financial institutions, finding limitless profit opportunities in the wild financial markets of the period, borrowed heavily to pursue those opportunities. As a result, financial sector debt increased from 21% of GDP in 1980 to 117% of GDP in 2007. At the same time, financial institutions’ holdings of the new high-risk securities grew rapidly. In addition, excess productive capacity in the industrial sector gradually crept upward over the period from 1979 to 2007, as consumer demand increasingly lagged behind the full-capacity output level.

The above trends were sustainable only as long as a big asset bubble continued to inflate. However, every asset bubble eventually must burst. When the biggest one – the real estate bubble – started to deflate in 2007, the crash followed. As households lost the ability to borrow against their no longer inflating home values, consumer spending dropped at the beginning 2008, driving the economy into recession. Falling consumer demand meant more excess productive capacity, leading business to reduce its investment in plant and equipment. The deflating housing bubble also worsened investor expectations, further depressing investment. Finally, in the fall of 2008 the plummeting market value of the new financial securities, which had been dependent on real estate prices, suddenly drove the highly leveraged major commercial banks and investment banks into insolvency, bringing a financial meltdown.

Thus, the big financial and broader economic crisis that began in 2008 can be explained based on the way neoliberal capitalism has worked. The very same mechanisms produced by neoliberal capitalism that brought 25 years of long expansions were bound to eventually give rise to a big bang crisis.

This occurred during the election season. In the midst of the crisis, the nation voted for "hope and change" in the person of Democrat Barack Obama. It looked the most apocalyptic prophesies of Peak Oil might be coming true.

Next - Strange Days, the final chapter.

Man, great reading. I really appreciate the even keel tone with which you discuss these matters. There is generally too much alarmism in the alternative media circles.

ReplyDeleteReally looking forward to the last installment.

Seconded!

ReplyDeleteThis comment has been removed by the author.

ReplyDelete